Portale ETS After Sales

Tutto a portata di mano Il nuovo portale ETS After Sales mette a disposizione dei clienti tutte le informazioni e le offerte di ETS After Sales in un unico portale centrale. Approfittate della comoda opportunità di avere tutto a portata di mano:- Promozioni per Ricambi Originali ETS® e Accessori Originali ETS®

- Catalogo on-line di pezzi di ricambio originali ETS

- Documentazione tecnica

- Carburanti consentiti

- Dati relativi alle offerte e ai contatti della rete assistenza di ETS

- Offerte per seminari e corsi di formazione

Listino Ricambi MAN variazione Febbraio 2026

Dal 01 Febbraio 2026 sarà presente all’interno del ETS after sales Portal, un nuovo aggiornamento del listino ricambi MAN.

Per consentire il carico dell'aggiornamento del listino nei nostri sistemi l'ETS Aftersales Portal rimarrà chiuso dalle 24 alle 72 ore a partire dalle 17 del giorno precedente all'entrata in vigore.

L’ufficio Ricambi ETS è a disposizione per qualsiasi necessità o...

› more

› more

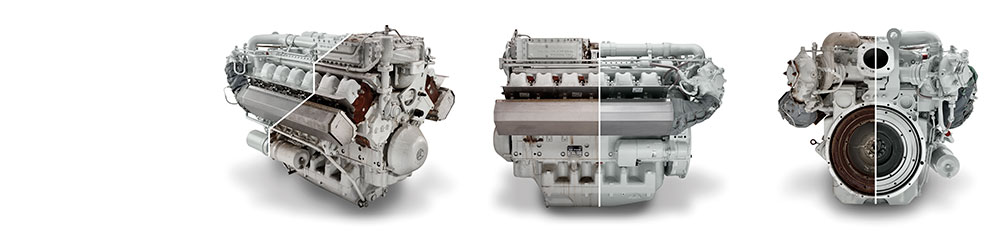

Procedura ordine e rientro ricambi ECOLINE ReMAN

Egregi,

Il programma dei motori rigenerati ReMAN, con il progressivo arricchimento del portafoglio prodotti, cambia procedura per la gestione del reso ReMAN.

Come già saprete, tutti i motori ReMAN sono prodotti originali rigenerati che possiedono gli stessi standard qualitativi e di efficienza dei motori originali nuovi, godendo inoltre della stessa garanzia pari a 24 mesi data fattura o...

› more

› more

Listino Ricambi MAN variazione Gennaio 2026

Dal 01 Gennaio 2026 sarà presente all’interno del ETS after sales Portal, un nuovo aggiornamento del listino ricambi MAN.

Per consentire il carico dell'aggiornamento del listino nei nostri sistemi l'ETS Aftersales Portal rimarrà chiuso dalle 24 alle 72 ore a partire dalle 17 del giorno precedente all'entrata in vigore.

L’ufficio Ricambi ETS è a disposizione per qualsiasi necessità o...

› more

› more

Chiusura uffici e magazzino per festività Natalizie 2025

Egregi clienti,

desideriamo comunicarVi che gli uffici ed il magazzino ETS rimarranno chiusi i giorni:

24 dicembre 2025

31 dicembre 2025

02 gennaio 2026

05 gennaio 2026

Per tutti i clienti con un contratto di manutenzione, sarà mantenuta l’operatività del servizio assistenza.

Desideriamo ringraziarVi per la fiducia accordataci ed auguriamo a Voi tutti ed alle Vostre famiglie un...

› more

› more